Disturbances in copper mines increase copper prices fluctuated at a high level this week (week 10)

The inflection point of inventory still needs to be waited and watched. Peru's copper production this year may set a record, but copper mine disturbances have increased, and incremental demand for emerging industries has gradually increased. The overall macro atmosphere is warmer, and copper prices have fluctuated at high levels this week.

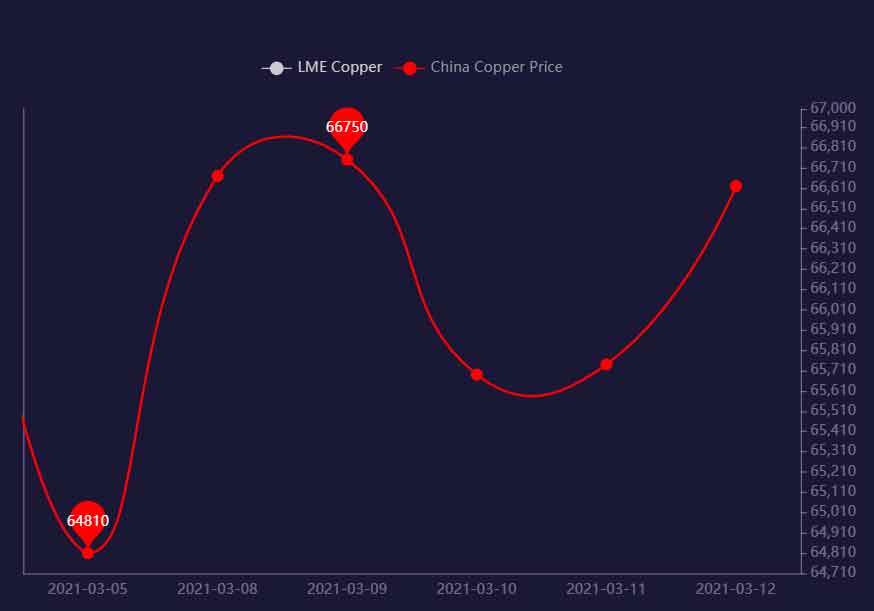

1. The trend of China spot copper prices this week

In the week of March 12, China's domestic spot copper prices fluctuated at a high level. The average price of 1# copper was reported at 66,146 yuan/ton, with an average daily increase of 338 yuan/ton, and a weekly increase of 2.61%; the average price of the previous week was reported at 66672 yuan/ton, a decrease of 526 yuan/ton compared with last week, a decrease of 0.79% from the previous week .

The tight supply of copper mines has not changed, the disturbances in Chile and Peru copper mines have increased, the Los Pelambres copper mine in Chile may strike, and the Antapaccay copper mine in Peru has suspended operations due to community blockade . However, Peru said that this year's copper output may reach a record 2.5 million tons, and mine output in major copper-producing countries is gradually recovering.

London's copper stocks have shown signs of rising since March, and the inflection point of copper stocks on the Shanghai Futures Exchange remains to be seen. In the first two months of this year, China's copper imports increased by 4.7% year-on-year, indicating that demand is still strong. The traditional peak season is approaching, the incremental demand of emerging industries such as wind power, new energy vehicles and other industries has gradually increased. Copper concentrate processing and refining costs have continued to decline, and copper prices have fluctuated at a high level this week.

2. One-week trend of copper futures prices

Lun Copper fluctuated this week. The average price of LME copper in the first four trading days was US$8,963/ton, an average daily increase of US$37/ton; the average price of last week was US$8998.2/ton, a decrease of 0.39% from the previous month.

China's February PPI rose more than expected year-on-year, thanks to improved demand, energy commodity prices and the base effect. The President of the United States formally signed a $1.9 trillion stimulus bill to strengthen confidence in economic recovery. The next priority is the large-scale transportation infrastructure bill. With the continuous advancement of global vaccines, anti-epidemic restrictions have been relaxed, and the prospects for economic recovery have improved significantly.

Shanghai copper oscillated this week . The average weekly settlement price of the current month contract was 66,180 yuan/ton, an average daily increase of 190 yuan/ton; the average price of the previous week was reported at 66,710 yuan/ton, down 0.79% from the previous week. Shanghai copper stocks continued to rise this week, increasing by 8,769 tons to 171,794 tons, an increase of 5.38%, and the cumulative increase in the past six weeks reached 158.08%.

3. Lun Copper Week Inventory Situation

Lun's copper stocks continued to rise this week, with a cumulative increase of 14,425 metric tons to 93,450 metric tons, a cumulative increase of 18.25%.

Fourth, hot finance at home and abroad

China:

1. China's February PPI increased by 1.7% year-on-year, which is expected to increase by 1.5%, and the previous value increased by 0.3%. Among the ex-factory prices of industrial producers, the prices of means of production rose by 2.3%, an increase of 1.8 percentage points from the previous month, affecting the overall increase in the ex-factory prices of industrial producers by about 1.71 percentage points.

2. China Automobile Association: China's car sales in February were 1.455 million, an increase of 364.8% year-on-year; the sales of new energy vehicles were 110,000, an increase of 584.7% year-on-year. Looking to the future, my country's economy will continue to recover steadily, and the policy orientation of steadily increasing the bulk consumption of automobiles and home appliances has been clarified.

International aspect:

1. After the seasonal adjustment in February, the non-agricultural employment population in the United States increased by 379,000, which is expected to increase by 182,000, and the previous value increased by 49,000. The epidemic has improved and epidemic prevention has been relaxed, and the US non-agricultural sector rebounded significantly in February.

2. The US Consumer Price Index (CPI) rose 0.4% month-on-month and 1.7% year-on-year in February. Excluding the volatile food and energy prices, the core CPI rose only 0.1% month-on-month, which was lower than market consensus.

Five, copper market news of the week

1. Workers at Chile’s Los Pelambres copper mine under Chile’s Antofagasta, one of the world’s largest copper producers, voted Tuesday to reject the company’s latest contract proposal, paving the way for a strike. The local law stipulates that a period of mediation mediated by the government must be entered.

2. The Minister of Energy and Mining of Peru stated that Peru's copper output may reach a record 2.5 million tons in 2021, much higher than last year's 2.15 million tons. The recent expansion of copper mines will help the country boost production, and the $1.6 billion Minas Justa project owned by Minsur will start in April or May.

6. Outlook for the copper price market outlook

There are still uncertainties in the recovery of the world economy, but with the widespread advancement of vaccination, investors are more optimistic about the economic outlook. The European Central Bank raised its economic growth expectations, and the European Central Bank stepped up its bond purchases to prevent interest rates from rising too fast. The core inflation in the United States in February fell short of expectations, but it continued to rise and was still in a controllable range, with limited impact on monetary policy.

China has put forward an economic growth target of more than 6%, and the economy is now back on track.

China will strengthen the construction of quality infrastructure and steadily increase the bulk consumption of automobiles and home appliances; new energy vehicles have set new monthly production and sales records for eight consecutive months. CRU predicts that global copper consumption will grow by 5.2% this year, and the rest of the world outside of China will grow by 7.1%. The demand for the electric vehicle industry has become the key to the growth of demand in the next ten years. The short-term inventory turning point has not yet appeared, but the peak season consumption is still expected, and the macro atmosphere is uncertain. It is expected that copper prices will continue to fluctuate next week.

Winland Metal supplies various grades of copper pipes and copper pipe fittings . Copper materials are widely used in various industries. Capillary copper pipes play a significant role in air conditioning, refrigeration, electronics and other industries.