China Nonferrous Metals Early Review on March 30

Copper price:

U.S. Treasury yields have risen again to push up risk aversion. LME copper fluctuated overnight and closed down $71. The market waited for the traditional peak season to start consumption. The current supply and demand sides are still stalemate, and today's copper prices are limited.

Aluminum price:

The U.S. dollar refreshed its high for more than four months. The aluminum alloy fluctuated overnight and closed at the end. The electrolytic aluminum production capacity was slowed down. However, the current fear of heights inhibits downstream consumption. It is expected that the current aluminum will not rise or fall much today.

Zinc price:

The United States plans to announce a 3 trillion infrastructure plan. Zinc prices fluctuated and closed overnight. Inner Mongolia’s “dual control” superimposed low processing fees. Domestic refined zinc output is being adjusted downwards. The zinc market is still strong, and zinc may rise today.

Lead price:

Profits of Chinese industrial enterprises increased, LME lead continued to rise overnight and closed up 0.77%, large primary refineries increased overhauls, secondary lead profit was low, and social inventories of lead ingots continued to decline, and lead may rise today.

Tin price:

The strengthening of the US dollar brought pressure, and Lunxi fell from its high level overnight to close up slightly by 0.1%; the Suez Canal was blocked for nearly a week and reopened, market supply concerns eased, and the upward trend of tin prices was limited. Tin is expected to remain stable today.

Nickel price:

U.S. Treasury yields rose again. Nickel fell 1.31% overnight. The increase in stainless steel production in Indonesia slowed down the growth rate of ferronickel's return. The profit of ferronickel was squeezed. The sellers' reluctance to sell nickel and nickel may stabilize today.

Copper Pipe

Distribute Winland Copper Pipe

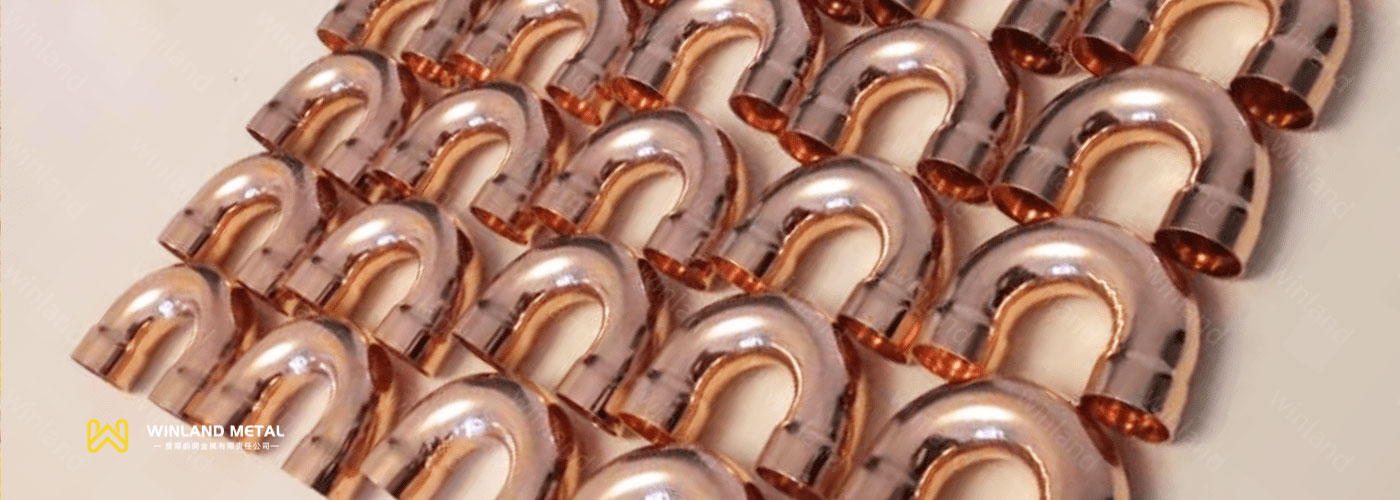

Copper Fittings

Distribute Winland Copper Fittings